Every member can apply to borrow up to £25,000!

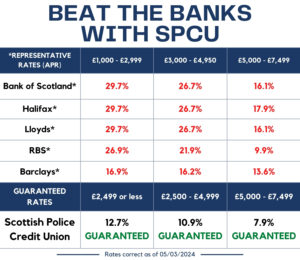

See our table below for our ‘Beat the Banks’ rates on loans up to £7,499!

Did you know – You can apply to ‘top-up’ your loan at any point. Simply visit our loan calculator and apply for the additional amount you need. Your new total loan will then be charged at the applicable rate for the total value.

Repayment periods can be up to 5 years for loans under £10,000 and up to 10 years for loans £10,000 and over.

You can apply online now, or by calling our team during office hours on 0141 771 1314.

Please note all applications are subject to approval and we strongly recommend you have your finance in place before committing yourself to any purchase.

Payment Waiver – An excellent loan feature at no additional cost to you!

Payment waiver is our loan insurance cover and comes as a feature of all our loan products.

If you are unable to work due to an accident or sickness you can claim on your payment waiver insurance after 4 months to make your loan repayments for up to 18 months (terms & conditions apply).

This means no arrears build up, your credit rating is not affected and your loan continues to reduce while you are off work.

To find out if you are eligible to make a Payment Waiver claim, contact our Loans team on 0141 771 1314.

(applicable on loans from 15/01/14)

Additional Info

Interest is charged on a daily basis and on the reducing balance each month therefore you pay more capital and less interest each month as your loan reduces.

There are no administration fees for setting up your loan. If you want to clear your loan early we do not charge you for that either.

Your Standard loan is insured at no cost to you, covering death, giving your loved ones peace of mind. (Terms & Conditions apply)

Cancellation Rights

If you wish to cancel your loan application, just let us know you no longer wish to proceed and it will be removed.

However, if your loan has been approved and loan funds have been allocated to your loan account, the folllowing conditions apply under the Distance Marketing Directive.

Loan applications not completed in person at our office can be cancelled in writing within 14 days of signing your loan agreement. Any funds paid to you must be returned within 30 days of cancellation.

Loans completed in person at our office cannot be cancelled under the Distance Marketing Directive. If you change your mind, you simply repay the full amount owing, together with any interest due, as agreed.